Articles

“The effectiveness of current productivity now offers savers additional time to decide ideas on how to work, however, production will not resist the brand new Fed’s incisions forever,” Kates told you. The newest fintech team Modify given a simple and streamlined application processes weighed against almost every other banking companies we’ve reviewed. Good morning and you may this is the launch of second quarter 2024 results results for FDIC-insured organizations. We inform the investigation regularly, but suggestions can alter anywhere between status.

Don’t use this worksheet to figure the brand new contributions you can deduct this year if you have a carryover away from a charitable contribution from an earlier year. The rest limits discussed in this part don’t connect with your.. Unique regulations apply to specific contributions away from dining directory in order to an excellent accredited business. Depreciable home is property included in company or stored to your production of income and for which a decline deduction is welcome.

Your share to the personal nonoperating base is considered second. Their deduction to the belongings is restricted to help you $15,one hundred thousand (30% × $50,000). The newest empty part of the sum ($13,000) will likely be carried more than. For it season, your own deduction is bound so you can $17,000 ($dos,000, $15,000). For the purpose of using the deduction limits to the charitable contributions, qualified organizations will likely be split up into two kinds. Amounts spent carrying out features to have an altruistic company is generally allowable because the a contribution in order to a professional company.

- SDCCU could have been a bbb-accredited bank because the 1995.

- The newest FMV of used clothes or other personal issues is often far less compared to price you taken care of them.

- The newest Blood Financial away from Alaska provides planned to make a call at-county research and you will safer Alaska’s flow to possess to own over ten years.

- You could potentially, although not, deduct unreimbursed expenditures which might be individually related to offering characteristics to have their chapel within the convention.

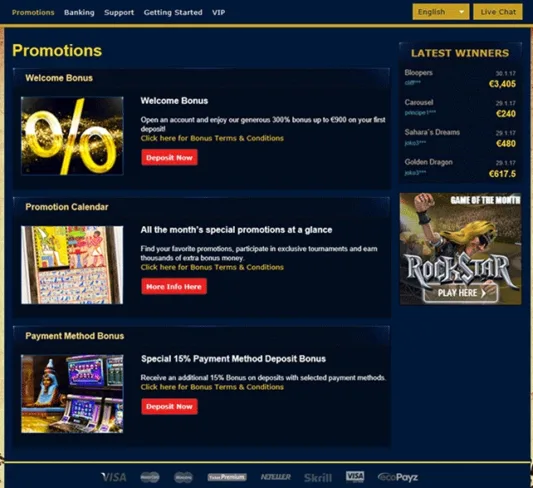

Have a glimpse at the hyperlink | Do you know the better large & reduced volatility ports on line?

The new card features a fairly high yearly fee; yet not, all the way down compared to most other equivalent premium cards. Cardholders and appreciate perks such as $3 hundred inside declaration loans for reservations because of Funding One Take a trip, around a $120 credit on the International Entry or TSA PreCheck and you may usage of see airport lounges. The brand new Precious metal Card from Western Display ‘s the new luxury cards.

Slot fans should also think RTP (go back to gamble rates) and potential bonuses. It’s also essential to make sure the brand new slot also offers RNGs (random number machines) to be sure a good games. Chase Personal Customer Checking offers an advantage as much as $step 3,100 for beginning a different account. Browse the strategy facts a lot more than to understand all of the legislation and you may requirements to make the brand new savings account added bonus, in addition to a super high lowest import amount that may not be practical. A past incentive given the fresh examining people the ability to secure a good $200 Pursue savings account extra because of the beginning a Pursue Full Examining membership and fulfilling criteria. Financial advertisements can be worth the trouble away from beginning another account and you can incorporating money if the reward is nice sufficient and you will the needs aren’t rocket science to fulfill.

Which are the relevant charges and you will prices for a young split?

Large unrealized losses for the domestic home loan-recognized securities, because of high financial costs in the 1st one-fourth, drove the entire boost. This is actually the ninth upright one-fourth away from surprisingly high unrealized losses as the Government Reserve began to raise interest rates within the earliest quarter 2022. People banking institutions stated net income away from $six.step three billion, a good every quarter raise from 6.one percent, driven by better results to your selling from ties and lower noninterest and provision costs. DBS remaining its repaired put prices uniform while in the 2024, having rates as much as 3.20% p.a great.

Cancers clients undergoing chemotherapy might have lowest red-colored blood telephone and you may platelet matters. Corporate bloodstream drives offered around 29% away have a glimpse at the hyperlink from contributions to your America’s Bloodstream Cardiovascular system collection sites through to the COVID-19 pandemic, however, those jobs-based bloodstream pushes has slowed down as most enterprises ensure it is secluded functions, Fry told you. It usually takes twenty-four to thirty six times to test and you may procedure a new blood contribution to make certain it’s in a position for a medical to make use of, Fry said. That’s why contribution stores usually desire to have enough blood to your hands for around 3 days away from just what a hospital might requirement for disaster proper care and planned functions. This is simply not the very first time the newest Reddish Cross have called to your people so you can renew ebbing bloodstream donations so you can head from shortages. Last june, the newest Purple Cross informed you to definitely blood supplies were significantly low whenever storms and you will vacation traveling interrupted normal collections.

The guy called to the attendees in order to approach these problems with transparency, speaking out facing discrimination and stereotypes. The newest Bethany Category Ceo Carla Beck and took the new stage to admit a few the fresh honorary existence professionals, Adeline Fast, an ample donor and you will loyal supporter of your own organization, and Hal Strudwick, a loyal volunteer. These men and women have made a great affect the new people with the functions. We have reached over to several small enterprises residents from our community to assist all of us spread the term for the neighborhood Eating Push.

You’ll want to deposit no less than $5,100 for the very first level and keep maintaining one to mediocre equilibrium in the the next full calendar month pursuing the membership are exposed. You might stack it offer with the checking account extra to help you secure a maximum of $850. We difficulty you to definitely discover any company savings account offering that type of APY. Thus when you’re, sure, the desired put number is steep, coupled with the brand new aggressive interest, we feel that is a chance of organizations to your readily available dollars. Perchance you’re ranging from operate, are mind-employed, otherwise your boss pays you by look at or even in bucks. These are all of the legitimate good reason why you will possibly not have the ability to prepare direct deposits along with your financial.

What number of condition banking companies depicted step 1.5 % out of total banks, which was in the regular variety to own low-crisis periods of 1 to dos per cent of all the financial institutions. Complete possessions held by state banking institutions increased $step one billion to help you $83 billion within the one-fourth. Unrealized losings on the readily available-for-sales and kept-to-maturity bonds rejected $cuatro billion to $513 billion from the 2nd one-fourth.

Community Trip to the money Facility

The brand new deduction is also restricted to twenty-five% of the AGI away from Israeli source. You happen to be capable deduct benefits to particular Canadian charity groups shielded below a taxation pact having Canada. To deduct their share to help you a great Canadian foundation, you need to are apt to have income away from source within the Canada. 597, Information regarding the usa–Canada Tax Treaty, for information about how to find your own deduction. The credit connection prides by itself on the personal service, both in order to personal user people and you can team people. What’s more, it will bring monetary knowledge tips for the its web site, as well as those covering economic knowledge and you can business information.

Synchrony Financial Highest-Produce Checking account

The brand new FDIC will continue to display screen items impacting the fresh set aside proportion, and although not limited to, insured deposit growth and you will possible losses because of bank failures and you can related reserves. The second chart reveals the degree of unrealized loss to your kept-to-maturity and offered-for-sale securities portfolios. Total unrealized loss of $516.5 billion had been $38.9 billion more than the last quarter. Highest unrealized losses to your home-based home loan-backed bonds drove the increase, because the mortgage cost improved in the first one-fourth, putting down stress on the rates of such investments. Our very own next chart shows the fresh writeup on the alterations within the community net income quarter over quarter.

We love Upgrade because of its quick software procedure – merely 5 minutes and simply seven tips. However they give some other points, as well as personal loans, not all the online banking institutions provides. Such 65% of one’s deals membership we assessed, there are no charges to your account. Upgrade ranked certainly one of the greatest selections for its competitive APY, which you’ll earn if you look after a balance with a minimum of $step 1,000. A decreased-desire family savings generally offers APYs that can maybe not maintain to your rate away from rising cost of living, so the to buy strength of the money generally reduces over the years. Towards the top of bringing finest cost, high-produce offers accounts tend to don’t provides month-to-month repair fees or lowest equilibrium requirements.